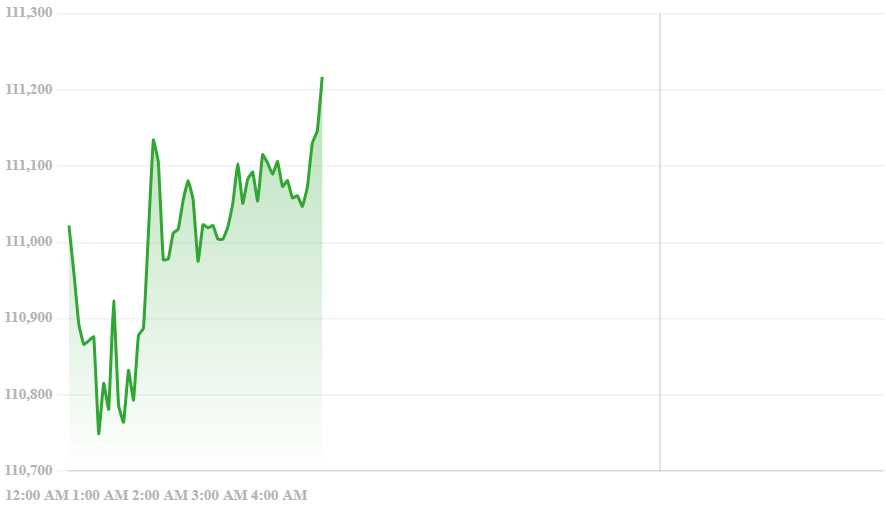

Bitcoin (BTC) is trading around US$111,417.

🔍 Market Overview

- Bitcoin (BTC) is trading around US$111,417.

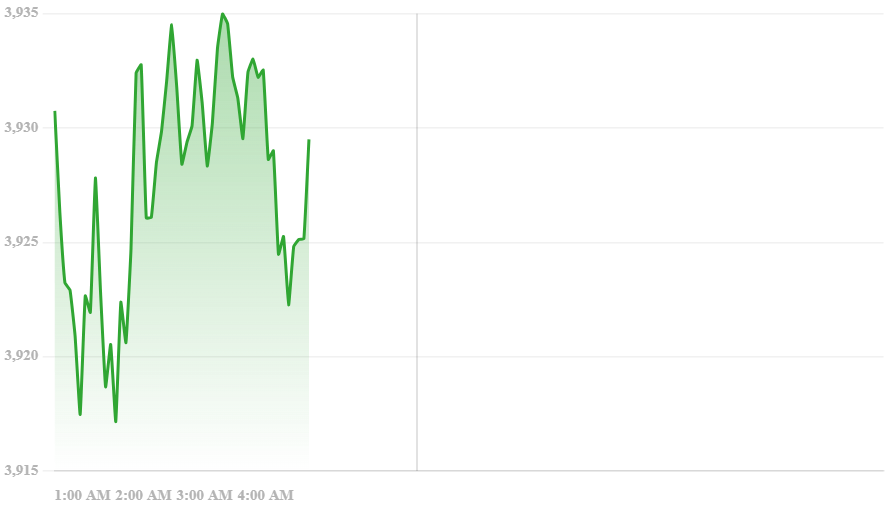

- Ethereum (ETH) is about US$3,934.71.

- The total crypto market-cap is estimated around US$3.6–3.9 trillion, up modestly in the last 24 h (~1–2%). Reuters+4Cryptonews+4Binance+4

- Trading volumes and derivatives interest are high: Q3 saw record futures/options volumes (combined >US$900 billion) and open interest hitting new highs. CME Group

Ethereum (ETH) is about US$3,934.71.

✅ What’s working / Positive signals

- Institutional participation appears to be increasing: more large open-interest holders and a broader base of derivatives players. CME Group+2Binance+2

- Despite recent dips, accumulation signals are visible for Bitcoin (medium-sized holders adding positions) which could hint at bullish structure. Investing News Network (INN)+1

- Ethereum has a cautiously bullish outlook if it breaks key resistance zones. CoinDCX

⚠️ Risks / Headwinds to watch

- October is shaping up to be one of the worst starts in years for Bitcoin vs its usual seasonal strength. Macro risks (e.g., U.S.–China tensions, weaker liquidity) are dampening upside. CoinDesk+1

- Big sell-offs earlier in the month (e.g., Oct 10-11) caused sharp drawdowns, which suggests leveraged positions and sentiment can flip fast. Reuters+1

- Regulatory & policy moves remain major wildcards (which is especially relevant for your blog given your interest in crypto business & branding). Reuters+1

📊 Outlook & what to keep an eye on

- If ETH clears resistance in the ~$4,100-4,260 zone, it could target ~$4,350-4,650 in the near term. But failure could drag it down toward ~$3,550 support. CoinDCX

- For Bitcoin: accumulation is good, but it needs macro support or a catalyst to break higher. Without that it could remain range-bound or even correct further.

- New altcoins and meme/ticket-coins are gaining attention (for better or worse) — risk/reward is higher but so is volatility. Indiatimes

- For your audience (brand/blog around crypto): Highlighting institutional adoption, regulatory changes, and macro-cross-asset links will resonate.

📝 Suggestions for your blog content

Given your goal of ranking for “crypto currency” and your entrepreneurial/branding focus, you could spin content around:

- The bigger picture: institutional growth + market structure changes (derivatives volume, open interest).

- Branding/Business implications: What does increased institutional adoption mean for crypto-brands/exchanges/startups (“if institutions are entering, what does that mean for local markets like Somalia/Africa?”).

- Risk management & strategy: Given the drawdowns this month and macro risk, provide actionable advice (for example: how entrepreneurs in your region should hedge/prepare).

- Dual-language approach: English + Somali side-by-side will serve your audience well.

- Localizing content: e.g., how global crypto moves impact African-based exchanges/agents (this ties into your MoneyGo/agent context).